Why Buying a Home Is a Sound Decision

If you’re thinking about purchasing a home in today’s market, you may need to be reassured that buying a home is a sound decision. And for many, that means taking into consideration what home prices are projected to do in the coming years and how that could impact your investment.

So far this year, we haven’t been seeing home prices fall dramatically. However, as 2023 goes on, some markets may go up in value while others may lose value. That’s why it’s helpful to not get overwhelmed by a short-term outlook. Instead, it’s best to keep the long-term view in mind. In fact, experts forecast a return to a steadier rate of price appreciation in the coming years.

Verify your mortgage eligibility (May 20th, 2024)Home Price Appreciation in the Years Ahead

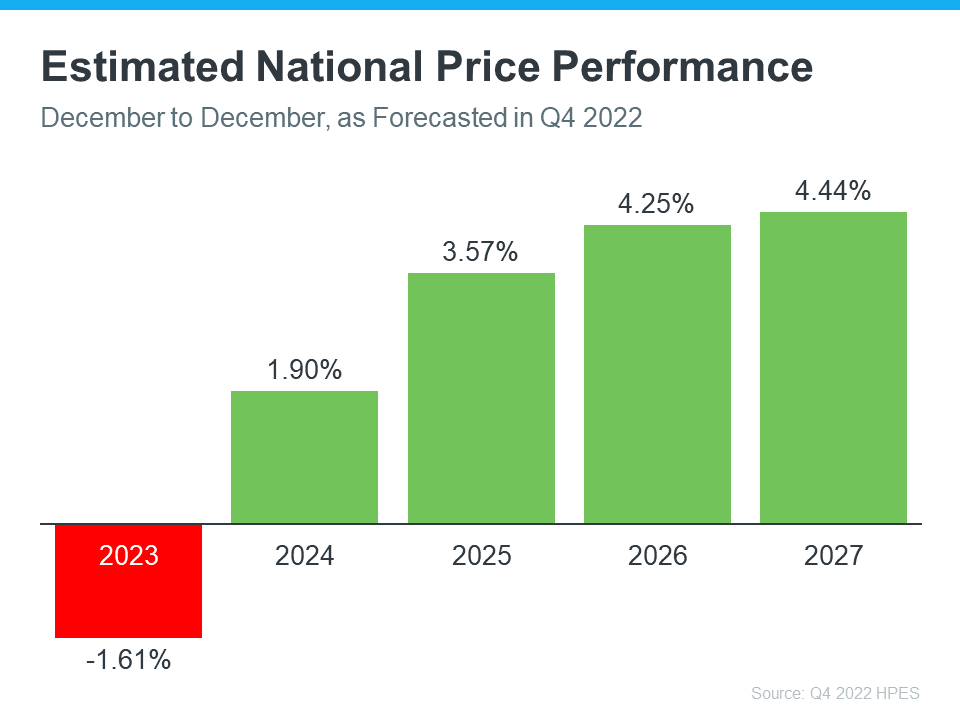

Over 100 economists, investment strategists, and housing market analysts were polled by Pulsenomics in their latest quarterly Home Price Expectation Survey (HPES). This report demonstrates what these experts believe will happen with home prices over the next five years. The graph below shows that, after mild depreciation this year, these experts predict that home prices will return to more normal levels of appreciation through 2027.

The significant conclusion is that the experts aren’t forecasting a drastic fall in home prices nationally. They do forecast that some markets around the country will see home price appreciation while others may depreciate. And when they look further out, they see steady price appreciation in the long run. That’s a great illustration of why homeownership wins over time and is key to building generational wealth.

Verify your mortgage eligibility (May 20th, 2024)What Does This Mean for You?

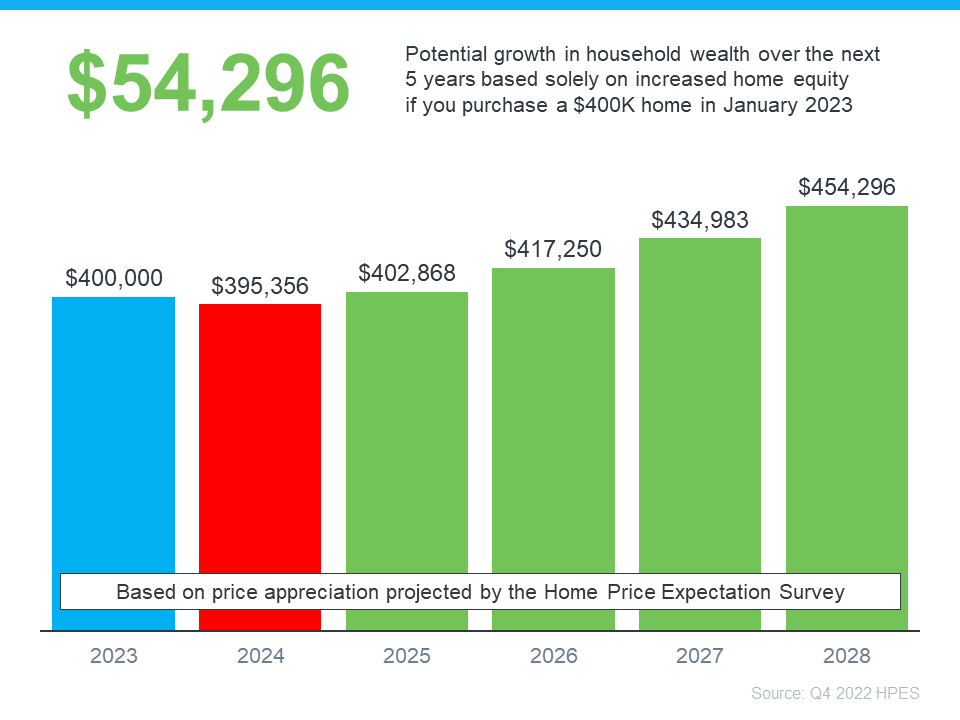

Once you own a home, price appreciation raises your home’s value over time which grows your household wealth. Based on the Price Expectation Survey’s price appreciation projections, here’s how a typical home’s value could change over the next few years (see graph below).

In this example, if you bought a $400,000 home at the beginning of this year and factor in the forecast from the HPES, you could accumulate over $54,000 in household wealth over the next five years. So, if you’re wondering if buying a home is a sound decision, keep in mind what a strong wealth-building tool it is long term.

Verify your mortgage eligibility (May 20th, 2024)Bottom Line

According to the experts, while we may see slight depreciation this year, home prices are expected to grow over the next five years. If you’re ready to become a homeowner, know that buying today can set you up for long-term success as home values (and your own net worth) are projected to grow.

Let’s connect so we can answer your financing questions, get you pre-approved for a mortgage, and set you up for success as you begin the home buying process.